davis county utah sales tax rate

Davis County 06-000 485 100 025 025 025 025 025 005 715. The Utah state sales tax rate is currently.

Utah Sales Tax Rates By City County 2022

The current total local sales.

. The median property tax in Davis County Utah is 1354 per year for a home worth the median value of 224400. What you will find in the US which is different from some other countries is that when you see the price of a product such as a t-shirt in a retail store or food. South Weber Davis County will impose an additional 1 transient room tax bringing the total transient room tax rate to 557.

The state sales tax rate in Utah is 4850. Local tax rates in Utah range from 0 to 4 making the sales tax range in Utah 47 to 87. See Publication 25 Sales and Use Tax General Information.

The Davis County sales tax rate is. Utah has a higher state sales tax than 538 of. UTAH CODE TITLE 59 CHAPTER 12 - SALES USE TAX ACT.

Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800. 274 rows Washington County. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

91 rows This page lists the various sales use tax rates effective throughout Utah. Davis County close to Bountiful UT. Box 618 Farmington Utah 84025-0618 Phone Numbers 801-451-3243.

This rate includes any state county city and local sales taxes. If November 30th falls on a weekend the due date is the following business day. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

Utah has a 485 statewide sales tax rate but also has 131 local tax jurisdictions including cities. The total sales tax rate in any given location can be broken down into state county city and special district rates. Has impacted many state nexus laws and sales tax collection requirements.

Farmington Utah 84025 Mailing Address Davis County Assessors Office PO. The current total local sales tax rate in Davis County. Koroulis George B Dixie - Trustees Situs.

You can use our Utah Sales Tax Calculator to look up sales tax rates in Utah by address zip code. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. Utah has 340 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

Property Taxes are due NOVEMBER 30th at 500 PM. Local-level tax rates may include a local option up to 1 allowed by law mass transit rural hospital arts and zoo highway county option up to 25 county option transportation town option generally unused at present by most townships and resort taxes. Utah UT Sales Tax Rates by City.

October 2018 Local sales and use tax rates will change in several cities and counties in Utah starting October 1 2018. The base state sales tax rate in Utah is 485. Box 618 Farmington Utah 84025 Phone Numbers 801 451-3250.

94501 Addl. Utah has recent. 61 South Main Street Farmington UT 84025.

Utah has several different counties 29 in total. The Annual Davis County Delinquent Tax Sale was brought to you by. Farmington Utah 84025 Mailing Address Davis County Treasurer PO.

You may also call the Tax Commission at 801 297-7705 or toll free at 1-800-662-4335 ext. The Utah UT state sales tax rate is 47. Find your Utah combined state and local tax rate.

2020 rates included for use while preparing your income tax deduction. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. Depending on local jurisdictions the total tax rate can be as high as 87.

Fax Hours Monday Friday 800 am. Farmington Utah 84025 Mailing Address Davis County Treasurer PO. May 18th 2022 1000 am - Pre-registration starts at 900 am.

Box 618 Farmington Utah 84025-0618 Phone Numbers 801-451-3243. 7705 or email to taxmasterutahgov. Davis County collects on average 06 of a propertys assessed fair market value as property tax.

Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835. Tax Rates Subject to Streamline Sales Tax Rules OTHER TAXES APPLY TO CERTAIN TRANSACTIONS Rates In effect as of April 1 2021 Please see instructions below Cnty. UT Rates Calculator Table.

Utah has a 485 sales tax and Davis County collects an additional 18 so the minimum sales tax rate in Davis County is 66499 not including any city or special district taxes. The 2022 Davis County Delinquent Tax Sale will be held. Davis County Administration Building Room 131.

You may also call the Tax Commission at 801 297-7705 or toll free at 1-800-662-4335 ext. The latest sales tax rates for cities in Utah UT state. We encourage payment of property taxes on this website see link below or IVR payments at 877 690-3729.

With local taxes the total sales tax rate is between 6100 and 9050. Davis County UT Sales Tax Rate. Utah sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Mobile and manufactured homes may be subject to tax sale when the outstanding taxes are one year delinquent. 2020 rates included for use while preparing your income tax deduction. Annually a public auction is held for.

To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824. Utah is ranked 964th of the 3143 counties in the United States in order of the median amount of property taxes collected. Rates include state county and city taxes.

The various taxes and fees assessed by the DMV include but are. The 2022 Davis County Delinquent Tax Sale will be held. The table combines the base Utah sales tax rate of 625 and the local county rates to give you a total tax rate for each county.

Properties may be redeemed up to the time of sale. The 2018 United States Supreme Court decision in South Dakota v. Annually a public auction is held for any property which has delinquent taxes.

This table shows the total sales tax rates for all cities and towns in Davis County. 20214 Parcel ID 04-046-0036 Owner.

What Is Utah S Sales Tax Discover The Utah Sales Tax Rate For 29 Counties

What Is Utah S Sales Tax Discover The Utah Sales Tax Rate For 29 Counties

Tax Rate Proposal Davis School District

What Is Utah S Sales Tax Discover The Utah Sales Tax Rate For 29 Counties

Davis County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Davis County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

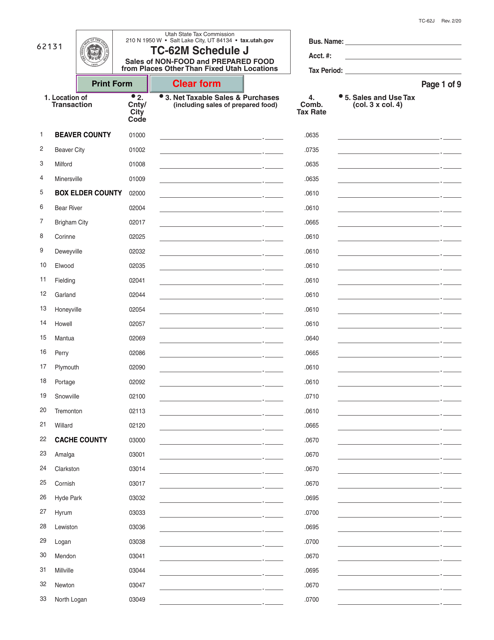

Form Tc 62m Schedule J Download Fillable Pdf Or Fill Online Sales Of Non Food And Prepared Food From Places Other Than Fixed Utah Locations Utah Templateroller

What Is Utah S Sales Tax Discover The Utah Sales Tax Rate For 29 Counties

The Jeff Davis County Georgia Local Sales Tax Rate Is A Minimum Of 7

Utah Resources Main Wazeopedia

Tax Rate Proposal Davis School District

Davis County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More